Simple, turnkey software solution for

College cost clarity

College planning is retirement planning and top of mind for Gen-X families.

brightness_alert

Sign up to access free resources and schedule a demo to learn how we can help.

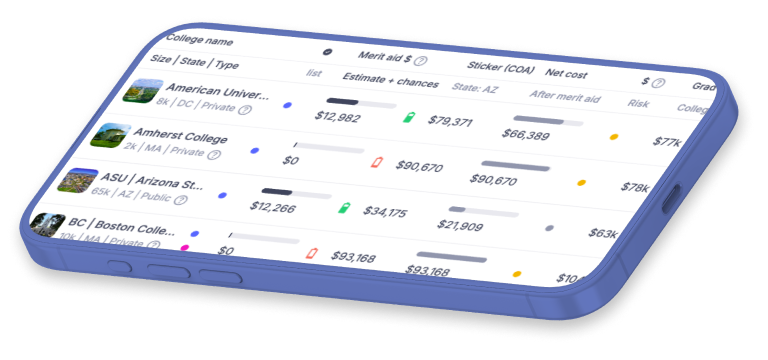

Personalize costs

4-year cost projection for each college based on student academics and family finances (merit and need).

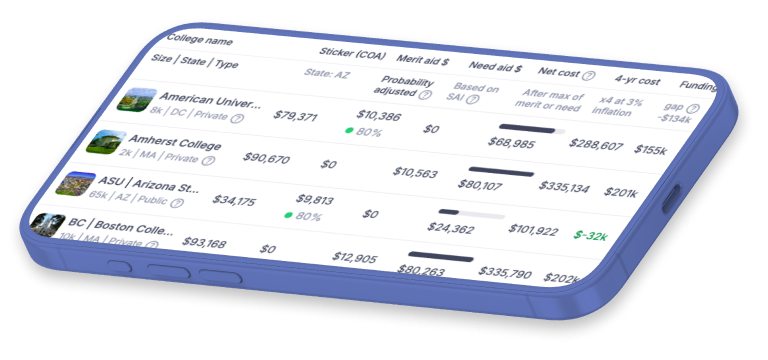

Find funding gap

User-friendly pathway from what does college cost to how do we pay for it, opening up conversations.

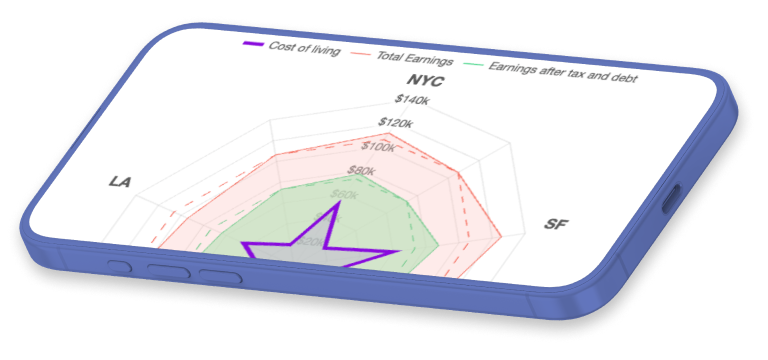

Compare outcomes

Empower families preview alumni lifestyle for each major and city based on their costs and funding gap.

Why add college planning

College is parents’ top savings priority

Stats from Fidelity Investments College Savings Indicator Study

73% saving for education

62% saving for retirement

57% saving for emergencies

33% of families know to appeal

62% saving for retirement

57% saving for emergencies

“GradBetter shows our clients their funding gap in minutes, so we can tailor our solutions. It’s a clear differentiator that helps us qualify which families we can serve best. We’re meeting families where they’re focused without having to train our advisors to become college aid experts.”

Todd Fothergill

Project Management & Promotions, The Vermont Agency

Our software helps

Empower clients with college cost insights

Address this immediate concern without adding financial aid to your plate.

Retirement impact

College costs can undermine the retirement savings outlook.

Multi-generational

Engage both spouses, the student and often grandparents.

Client acquisition

Reach 40-55-year-old parents with college bound students.

Client engagement

23% of grandparents say saving for grandkids college is #1 goal.

Marketing materials

Visual reports with insights into which colleges offer savings.

Simple implementation

Families identify financial fit while becoming qualified leads.

Get a personal tour

See how GradBetter helps financial advisors engage families on college planning.

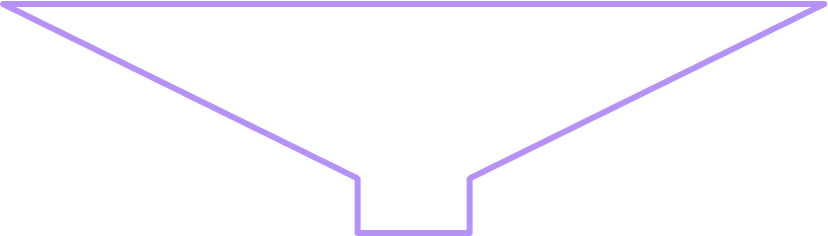

Ultimate marketing funnel

Cost clarity leads to financial planning

Learn family finances as they personalize costs and solve how to pay.

Presentations

Move attendees to qualified leads.

Direct marketing

Go from emails to family finances.

Social media

Address costs, loans + outcomes.

Financial info

Learn income, assets, home equity.

Academic info

Families save with merit insights.

Contact info

Capture info and family structure.

Frequently asked questions

If a client has multiple children, can they use one parent account?

Yes. Our multi-student accounts allow parents to manage all their children from one account while customizing the information and analysis to each student. This provides a family level view of paying for college.What is included in the price?

Access to our merit insights and cost analysis tools to provide families with a personalized 4-year cost projection along with scholarships available, scholarship displacement info, borrowing analysis and the ability to preview alumni lifestyle. Advisors can generate visual reports or simply share their branded merit + cost link, which helps families find their funding gap on their own in minutes. Many advisors use their link for client acquisition as it qualifies the lead based on family finances.How long are memberships and what is the price?

Monthly or annual. Families joining through an advisors branded link will receive free access. Financial advisor plans start at $100/month or $1,200 per year depending on the number of families the advisor plans to serve or invite.How much information do families need to share?

Merit aid is based on academics. Families can access a user-friendly need estimator without sharing financial information beyond their adjusted gross income, home equity and parental assets.How long does it take to get up and running?

Financial advisors can sign up on their own, upload their company logo and start sharing their branded landing page directly with families to access college average info. Families will see a paywall on merit insights until the advisor activates a paid membership. We encourage advisors to schedule a Zoom to review the advisor and family experience first.Will you be emailing our families?

No. We provide a branded landing page for financial advisors to share.Will you do an online presentation for families?

Yes. We’d be happy to do a Zoom for advisors, parents and students.How do you protect my information?

The database has real-time standby replicas to prevent any data loss between nightly backups on Amazon AWS. Multiple application servers are deployed for redundancy. A firewall protects unauthorized server access and SSL encryption keeps data safe and secure with an Amazon root level certificate.